Welcome to part two of Global Mobility Insights for 2024. Within this second of three articles, you will find a summary of key events & challenges which are likely to impact your global mobility programme over the coming weeks and months.

You will also find guidance from K2 on how best to approach these challenges/mitigate their impact.

The Paris 2024 Olympics

As the Olympics (26th July – 26th August) and the Paralympics (26th August – 8th September) approach, we are starting to see landlords in Paris serve notice to long-term tenants so that they can rent out their properties at a much higher rate during the Games. As a result, the availability of long-term housing in Paris is reducing, and is likely to continue doing so as the year progresses.

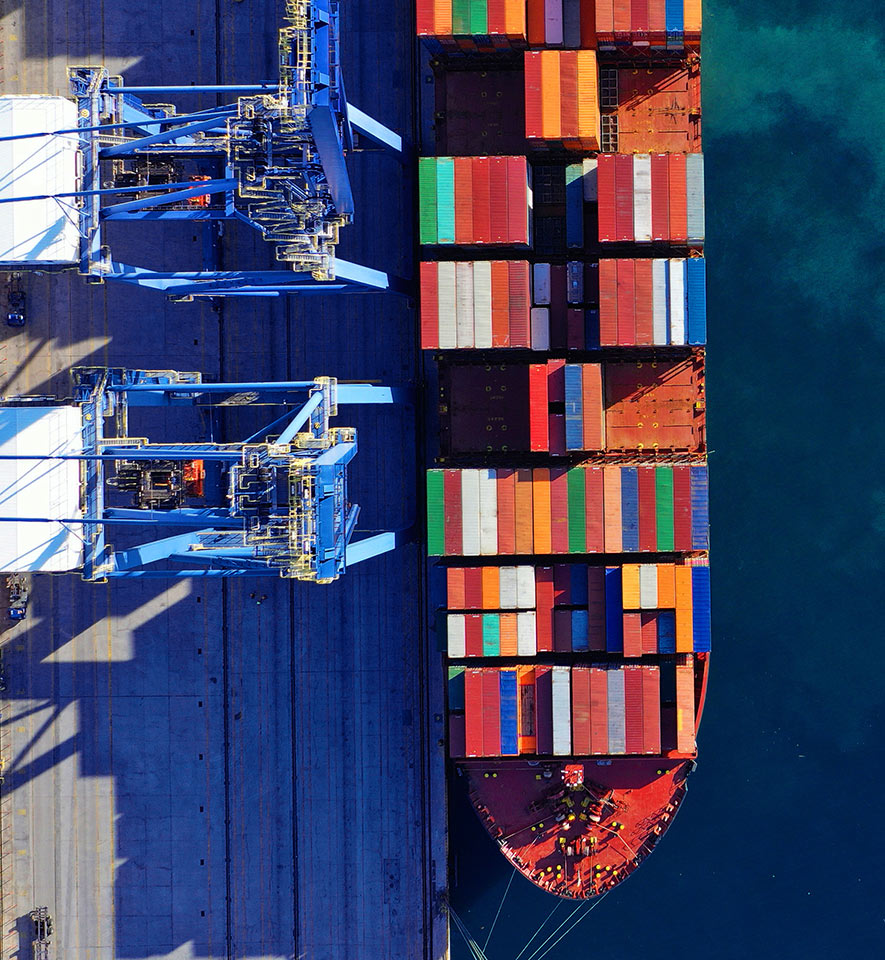

Shipping around the globe

South Africa

South African ports have been experiencing severe delays since October 2023. Recently, however, the situation has improved, with delays lasting 6 – 8 days, rather than the previous 14 days.

Many shipping lines are continuing to use alternative transhipment ports such as Port Louis, Coega and Walvis Bay for imports and exports. Given this change in vessel approach, an increase in rates is to be expected. However, this additional cost is much lower than the cost which would be incurred if a container ship were to get stuck in a congested port.

Over the coming weeks, we expect to see the length of the delays at ports in South Africa continue to reduce.

Argentina

Javier Milei has been elected president of Argentina for the next four years. Following his election, March and April 2024 can be expected to be challenging months due to political unrest.

Shipments will operate following previously successful security protocols. Trucks will only be moved during the early hours of the morning and cargo will be sent to the bonded warehouse using only main and secure routes such as highways, which cannot be disrupted by political demonstrations. As a result we are likely to experience increases in freight rates, especially via air. This will be monitored and K2 partners and clients will be kept informed.

There is also an expectation of increased customs clearance times due to the close linkage of the customs function and political change imposed by the new government. The scarcity of anti-narcotics dog brigades used during customs inspections will also contribute to longer clearance times. Currently, highly conservative estimated timelines are being provided to manage customer expectations. Logistically, there is an expectation of reduced frequencies of every carrier to and from Argentina. This will likely last until June or July 2024.

Many vessels are currently being cancelled, excluding those arriving into or departing from the port of Buenos Aires. Bookings are being rolled onto subsequent vessels, affecting both exports and imports. Staff are highly trained in dealing with these scenarios. They know how to avoid disruptions to daily operations and are prepared to help clients to get organised well in advance to guarantee minimal disruption to services.

Brazil

The grounding of a container ship just inside the southern mouth of the Suez Canal in May 2023 disrupted global trade and is still impacting ocean freight prices. Currently freight charges from Brazil are experiencing an uplift in the region of 10%.