Content:

If you prefer to explore the insights in full, you can download our extended guide here.

The guide includes city-by-city indicators, planning timelines, early market signals, and detailed questions to support mobility decision-making.

What pressures could mobility teams expect as 2026 approaches?

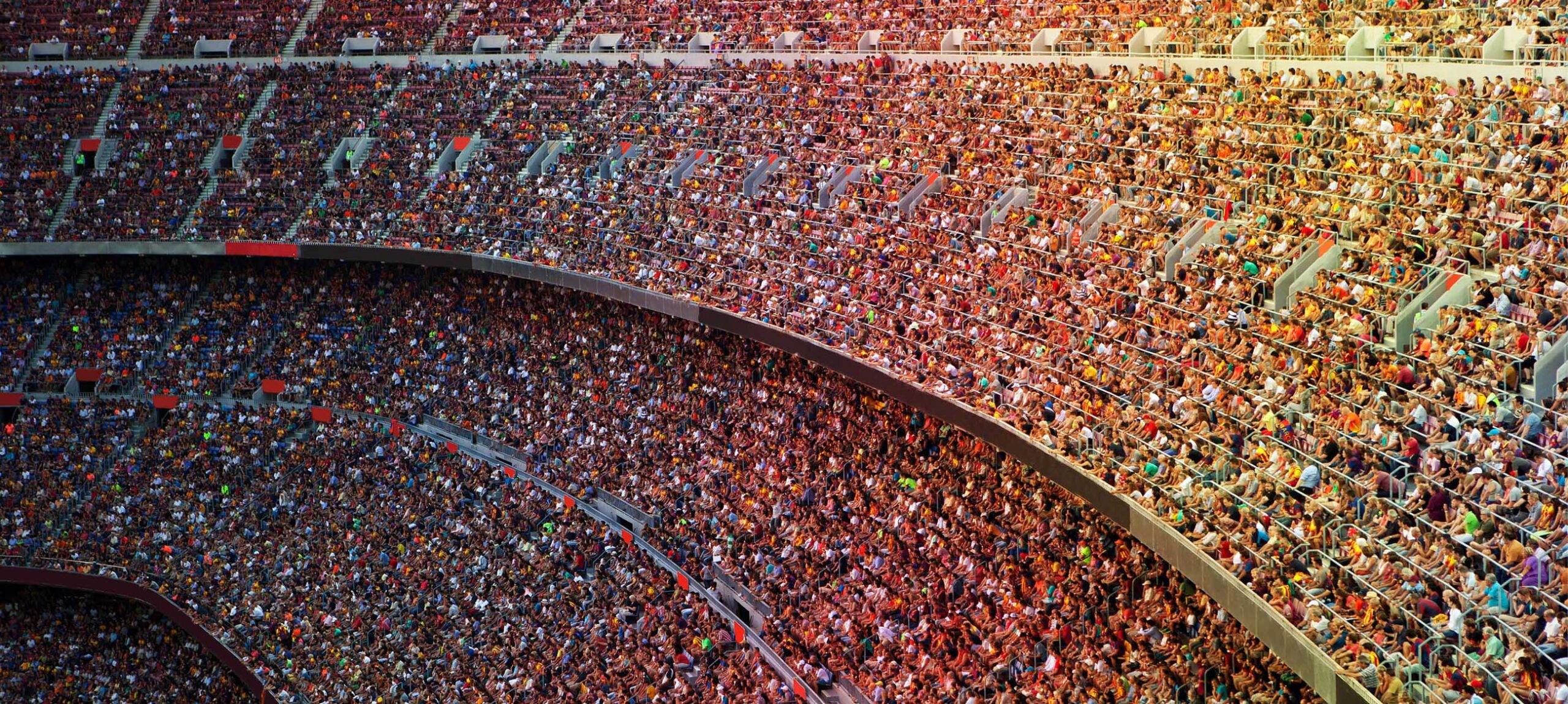

The 2026 World Cup will attract millions of visitors to major US cities, leading to unusual demand patterns well before the tournament starts. For mobility teams organising relocations, short-term assignments, or intern arrivals, these shifts are significant. Early indicators are already emerging in various housing and travel markets.

According to CRE Daily, rental availability in some host cities is tightening as short-term rental activity begins to increase ahead of 2026 (link). Bisnow reports that short-term rental conversions are expected to accelerate as visitor demand grows, which could reduce the inventory of corporate housing and serviced apartments (link). Research from Danredev LLC suggests neighbourhoods around stadium locations may be the first to feel the impact, with greater volatility in pricing and availability (link).

These movements do not indicate a crisis, but they do highlight the need for earlier planning and scenario thinking. Mobility timelines that worked in previous years may need adjustment in 2026.

How might temporary accommodation behave in host cities?

Temporary housing has always been sensitive to large scale events. For 2026, many mobility teams are already asking: How soon must we secure short term accommodation for relocating talent?

- Shorter lead times for available units

- Increased competition for mid-range and higher-quality inventory

- Pricing movement in neighbourhoods close to venues

- Seasonal pressure for summer intern arrivals

Insights from our accommodation partners offer a balanced view of what to expect.

Suite Home Chicago, with a strong focus on the US market, notes that major events often condense availability windows and increase competition for corporate housing, especially in cities already operating near capacity. Their early assessment suggests that 2026 will likely follow this trend as demand rises across multiple guest groups both locally and nationally (link).

SITU provides a global perspective, highlighting how changing traveller expectations, especially among younger assignees, are increasing the preference for apartment-style accommodation over hotels. This trend is not confined to the US and indicates that the type of inventory most commonly used by mobility programmes may see increased demand in 2026, regardless of location (link).

Together, these insights offer both a US-specific and an international perspective on how temporary accommodation may behave during a year marked by heightened demand. They also highlight why intern programmes, graduate placements, and project-based resourcing might need earlier planning and increased flexibility.

Will travel and scheduling flexibility change?

Hotel News Resource has reported that hotel occupancy across host cities is expected to increase ahead of the tournament, following patterns seen in previous FIFA events (link). While mobility activity is not directly competing with tourism, increased demand might impact:

- Preferred arrival windows

- Flight flexibility into major hubs

- Orientation or home search scheduling

- Short notice travel for business-critical moves

Mobility teams might benefit from planning ahead or keeping alternative options available for important dates.

What will this mean for destination support?

Increased city activity can affect the rhythm of destination services. Traffic volume may impact access to neighbourhoods. Property viewing times may become more limited. Household goods deliveries might need to be booked earlier due to congestion.

These are not barriers, but rather planning considerations. The impact will differ between cities, and our extended guide details how these scenarios could unfold in 2026.

How should mobility programmes prepare for 2026?

The most helpful questions to explore now include:

- Where your people will be landing

- Whether specific arrival periods may be more constrained

- How intern and graduate intakes coincide with city pressure

- Whether alternative short-term housing patterns may offer more stability

- Which parts of the mobility timeline benefit most from early action

Our guide elaborates on these questions and provides structured planning prompts that teams can utilise internally.

Where to explore the insight in more detail

This article introduces the headline indicators, but the guide provides a deeper perspective, including planning timelines, city-level observations, additional market signals, and practical solutions for 2026.

You can download the full guide here.

If you would like to explore how these themes relate to your specific moves or programmes, you can contact your local K2 office here.

For ongoing support throughout 2026, please reach out to your account manager.